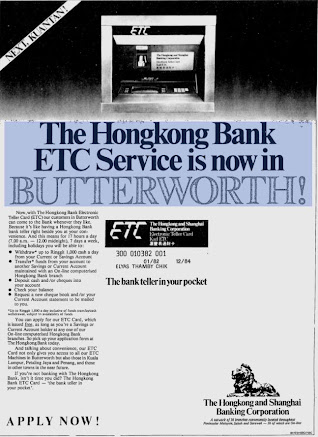

The first cash-dispensing machines were introduced in Penang in the early 1980s by the Hongkong & Shanghai Banking Corporation. I remember that two or three such machines were first installed at the bank's two premises in Beach Street and Downing Street in downtown George Town, and later at their Butterworth branch in Province Wellesley. It created a mild excitement and people started opening accounts at this bank just to apply for their Electronic Teller Cards, more commonly known as the ETC card. At that time, users were limited to only three cash withdrawals in a day and I think they were also limited to $200 per transaction. Nevertheless, the service was available from 7am until midnight daily, seven days a week. It was a little later that these cash dispensing machines were upgraded to full-function ATMs with other features.

By the mid-1980s, the ATM card revolution had taken a firm footing in Malaysia. I'm actually quite proud to say that I had a part to play in its growth in the country. In 1986, a consortium of financial institutions formally announced the launch of the pioneer shared ATM network in the country. The company behind the consortium was called EFT Systems (M) Sdn Bhd but the network's name would be called GREAT, standing for GRoup Electronic Automated Teller. The six founding members of EFT Systems would be Ban Hin Lee Bank (BHL Bank), Oriental Bank, United Asian Bank, Arab-Malaysian Finance, Hong Leong Finance and MBf Finance. The GREAT network was actually competing with the rival MEPS network to be the first to launch and we beat them to it by several months. Sad to say, though, after the merger of banks in Malaysia in 2001, the GREAT network was eventually swallowed up by MEPS.

I was thrust into this project quite by accident as my then supervising officer suddenly quit her job - the challenge of working overseas was too great, she told me much later - and left me to take over as the unofficial head of the ATM Centre at Ban Hin Lee Bank. Carrying the baby, so to speak.

But first, before we could even implement the shared network, we had to get our own proprietary network up and running. The bank ran an internal competition to pick a name for the ATM card but eventually, the consortium decided that all the participating institutions should use the common GREAT name for group visibility and marketing.

Months of development work and testing of the proprietary ATM network followed. While the developers (the external developers working with the internal Information Technology staff) were busy upstairs, my operational team was ensconced with a development ATM in the bank's meeting room at the back of the building in Beach Street. On many days we would be living there from nine o'clock in the morning till five o'clock in the afternoon, feeding dummy transactions into the machine and testing it out in all sorts of manner to simulate technical and operational errors and faults. As a bank, it went without question that the integrity of any financial system must be secured because the security of customers' money was central to any banking feature.

At the same time too, we began testing the shared ATM network with the other partners. Using the same test script that had served us well at the proprietary level, we ran a whole range of comprehensive tests at the shared level. (Actually, the proprietary tests were based on the shared tests, but let's not quibble here.) At first the tests were carried out on a one-to-one basis and it all ended with a complete stress test with all financial institutions together a few weeks before the official launch on 27 October 1987.

Even after the launch of the shared network, there was no resting on our laurels. EFT Systems and the GREAT ATM network were small, some said we were bold to take on the bigger boys in the industry. What we lacked in size, we made up for our modest size with a lot of enthusiasm and innovation. Within a year or two, we introduced the bill payment system in Malaysia, offering payments initially for Tenaga Nasional and Telekom Malaysia bills. Pihak Berkuasa Air Pulau Pinang came later. We installed ATMs in a few factories to promote this service and I remember Hewlett-Packard and Conner Peripherals as our two biggest customers.

I continued to be fully involved with the project for many more years. Running the ATM Centre meant that I had to attend monthly meetings at the EFT Systems office in Kuala Lumpur with the other ATM Centre representatives. Also, because Ban Hin Lee Bank was alone in being located outside Kuala Lumpur, I also had to participate actively in the technical meetings on the same day as the operations meetings. So I did learn a lot of stuff during my six or seven years in this project and made a lot of friends in the process.

Ban Hin Lee Bank's ATM service....they were some of the best years of my work life.

Other Ban Hin Lee Bank stories here.

Ban Hin Lee Bank's ATM service....they were some of the best years of my work life.

Other Ban Hin Lee Bank stories here.

I still remembered those years. Very memorable indeed. :)

ReplyDeleteI knew Michell Wan Zhen :p

ReplyDeleteI was representing AMFB in that project

ReplyDelete